Term Insurance for Senior Citizens

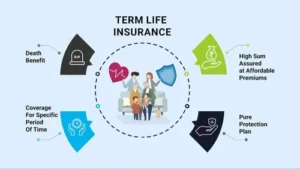

It is often advised to buy term insurance as early as possible in life, ideally in your 20s or 30s. But that does not mean that you can’t buy it after that age has passed. Even senior citizens who are aged above 60 can buy term life insurance to financially protect their loved one’s future in case of their untimely demise. Do not miss out on insuring your family’s life, assuming that you cannot buy or are not eligible to purchase term insurance as a senior citizen. Read on as we explain why term insurance for senior citizens is important, the features and benefits of buying it, and how to choose the right term plan.Show Less

To delay is to regretYou may not always be around to take care of your family. And that’s when a term plan ensures your family is well protected.

Life Cover of 10 Crore @ Rs 170/day***